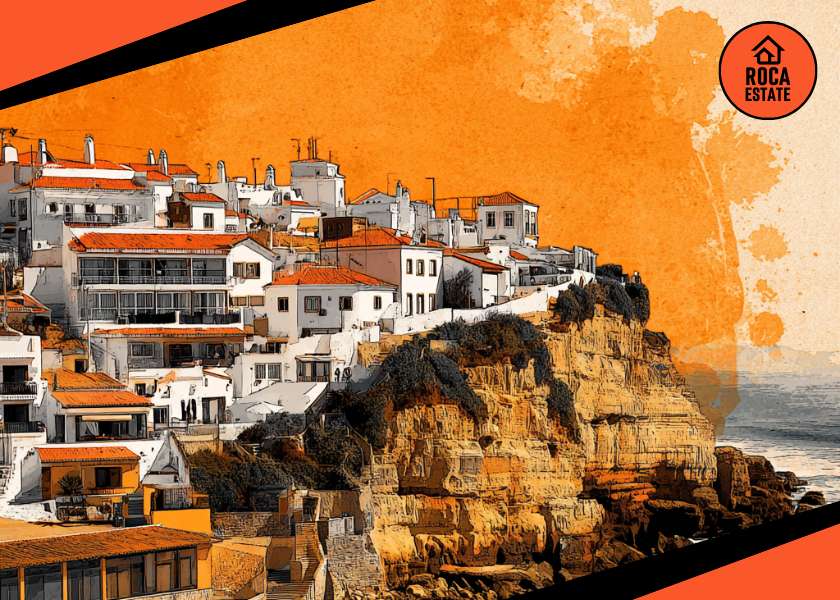

Welcome to Lagos, a city where the allure of serene beaches meets a vibrant urban lifestyle. As Roca Estate, a premier real estate agency in Portugal, we present this guide to the city’s most captivating sights. Whether you’re contemplating a move or seeking investment opportunities in Lagos, our insights will help you understand the unique appeal of this coastal gem. Join us in exploring the essence of Lagos, from its stunning natural landscapes to its rich cultural offerings.

Lagos: A Coastal Haven with Endless Opportunities

Lagos, located in Portugal’s picturesque Algarve region, is a city that offers a unique blend of serene coastal beauty and a vibrant urban atmosphere. Known for its stunning beaches, historic architecture, and warm, welcoming community, Lagos is a showcase of tranquil yet energetic living.

The lifestyle in Lagos is a perfect balance of leisure and activity, appealing to a wide range of interests and preferences. Residents and visitors are drawn to its:

- Beautiful beaches and Water activities: Lagos is surrounded by some of the most beautiful beaches in Portugal, such as Meia Praia and Praia Dona Ana. These spots are ideal for sunbathing, swimming, and various water sports including surfing, kayaking, and paddleboarding. The clear waters and rich marine life also make these places ideal for snorkeling and diving.

- Rich Cultural Heritage: The city’s history is evident in its well-preserved architecture and numerous historical sites, like the Governor’s Castle and the Church of Santa Maria. Lagos also hosts a range of cultural events and festivals throughout the year, celebrating everything from local traditions to international music and art.

- Diverse Cuisine: Lagos offers a culinary journey through a variety of restaurants. From traditional Portuguese seafood dishes in local eateries to modern international cuisine in upscale restaurants, there is something to satisfy every taste. The city is also known for its fresh produce markets, where locals and chefs purchase ingredients for their culinary masterpieces.

- Outdoor Recreation: Apart from the beaches, Lagos is a paradise for outdoor enthusiasts. The surrounding cliffs and countryside offer excellent hiking and biking opportunities. Golf enthusiasts will find several world-class golf courses in and around the city, each offering a unique playing experience with breathtaking views.

- Vibrant Nightlife: As the sun sets, Lagos comes alive with a vibrant nightlife. The city boasts a variety of bars, clubs, and live music venues, catering to a diverse crowd and ensuring that there’s always something happening after dark.

When it comes to real estate, Lagos is a market that is as diverse and attractive as the city itself. Among the features of the local market:

- A Wide Range of Properties: From modern apartments in the city center to luxury villas on the coast, real estate options in Lagos suit different lifestyles and budgets.

- Investment Potential: The city’s popularity as a tourist destination and a desirable place to live makes it an attractive location for real estate investment. Properties in Lagos are known for retaining their value and offering good rental yields.

- Quality of Life: Investing in Lagos real estate is not just a financial decision but also a lifestyle choice. Property owners in Lagos enjoy a high quality of life with access to excellent amenities, healthcare, and education.

Lagos, with its unique combination of natural beauty, cultural richness, and a dynamic real estate market, offers an unparalleled living experience. Whether you’re seeking a permanent residence, a holiday home, or an investment opportunity, Lagos is a city that will satisfy your every desire.

Exploring Lagos: A Journey Through Its Must-See Attractions

Lagos, a city renowned for its stunning landscapes and rich cultural heritage, offers a plethora of attractions that fascinate visitors and locals alike. Each attraction in Lagos tells a story of its historical depth and breathtaking beauty. Join us on a journey to discover the iconic and unforgettable landmarks that define the charm and appeal of Lagos as a destination for unforgettable experiences.

Ponta da Piedade

Ponta da Piedade is famous for its extraordinary limestone cliffs, a natural masterpiece carved by the Atlantic Ocean. The towering cliffs and coastal arches set against the azure waters create a stunning visual spectacle. Visitors can take a boat tour through an intricate network of caves and grottos, offering an up-close encounter with this geological wonder. For those who prefer to stay on land, a walk along the cliff tops offers panoramic views of the sea and the Algarve coastline, making this an ideal destination for photography and nature lovers.

Praia Dona Ana

Praia Dona Ana is a gem among Lagos’ beaches, known for its golden sands enclosed by striking ochre cliffs. This sheltered cove offers calm, crystal-clear waters ideal for swimming and snorkeling, revealing a vibrant underwater world. The beach’s accessibility and facilities, including sun loungers and parasols, make it a favorite for families and those seeking a relaxing day by the sea. The natural beauty of Praia Dona Ana, combined with its serene atmosphere, makes it one of the most picturesque spots in Lagos.

Meia Praia

Stretching over several kilometers, Meia Praia is one of the largest and most popular beaches in Lagos. Its vast expanse of soft sand provides ample space for beachgoers to relax and enjoy various activities. The beach is particularly favored by windsurfing and sailing enthusiasts, thanks to its open landscape and consistent winds. Despite its size and popularity, Meia Praia retains a sense of tranquility, offering a perfect blend of leisure and relaxation against the backdrop of the Atlantic Ocean.

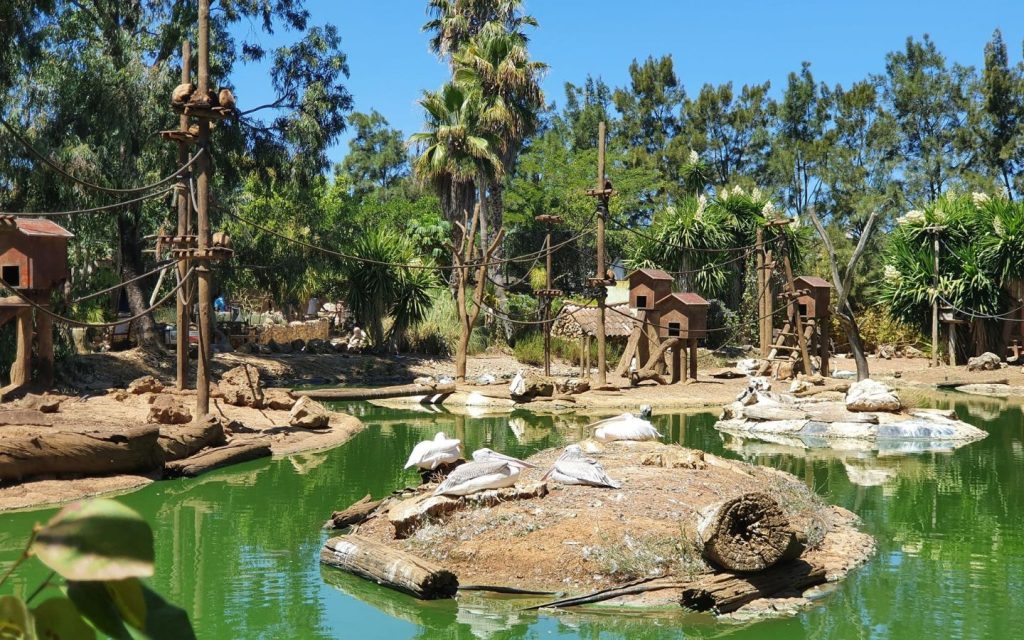

Parque Zoológico de Lagos

The Lagos Zoo is a delightful place for families and wildlife lovers. Home to a wide variety of animal species, the zoo focuses on conservation and education to provide visitors with an unforgettable experience. Well-designed enclosures allow for close interaction with the animals, while lush landscaped gardens create a relaxing atmosphere. The zoo’s commitment to animal care and its educational programs make it an important and interesting attraction in Lagos.

Praia do Camilo

The Praia do Camilo, a secluded beach nestled between the cliffs, is a hidden treasure of Lagos. Descending to the beach via a wooden staircase offers stunning views of the surrounding cliffs and crystal-clear waters. This small, cozy beach allows for privacy from the more crowded areas, so it is ideal for those seeking tranquility and natural beauty. The unique rock formations and clear waters also make Praia do Camilo a popular spot for snorkeling and exploring marine life.

Ponta da Piedade Lighthouse

The lighthouse at Ponta da Piedade stands as a historic landmark, offering breathtaking views of the Algarve coastline. Visitors can enjoy a stroll around the lighthouse, taking in the scenic beauty of the surrounding cliffs and ocean. The location is particularly spectacular at sunset when the sky and sea are painted with vibrant colors. The lighthouse serves not only as a navigational aid but also as a vantage point for appreciating the natural beauty of Lagos.

Centro Historico de Lagos

The historic center of Lagos is a vibrant and colorful area, brimming with character and charm. Wandering through its narrow cobbled streets, visitors will discover a variety of shops, cafes, and restaurants, each adding to the lively atmosphere of the city. The Centro Historico is steeped in history, with well-preserved buildings and landmarks that tell the story of Lagos’ past. This area is not just a tourist attraction but a living, breathing part of the city, offering a glimpse into the everyday life and culture of its residents.

Governor’s Castle (Castelo dos Governadores)

The Governor’s Castle, a significant historical site in Lagos, stands as a testament to the city’s rich and varied history. The fortress, with its imposing walls and strategic location, offers insights into the defensive architecture of the past. Visitors can explore the remnants of the castle and enjoy panoramic views of the city and the sea. The site’s historical significance and the stories it holds make it a must-visit for those interested in the heritage of Lagos.

Museu Municipal Dr. Jose Formosinho

The Museu Municipal Dr. Jose Formosinho is a cultural hub, showcasing a wide array of exhibits that span the history, art, and archaeology of the region. The museum’s collections provide a comprehensive overview of Lagos’ historical evolution, from ancient times to the present day. Visitors can explore artifacts, artworks, and displays that offer a deeper understanding of the area’s cultural and historical significance. The museum is not only an educational experience but also a journey through the rich tapestry of Lagos’ past.

Church of Santa Maria de Lagos

The Church of Santa Maria de Lagos is a beautiful example of religious architecture in the heart of the city. Its serene and solemn interior, adorned with artistic details, provides a peaceful retreat from the bustling streets. The church plays a significant role in the local community, hosting religious ceremonies and events. Its central location makes it an interesting and must-stop for visitors exploring the historical and cultural attractions of Lagos.

Each of these attractions in Lagos offers a unique experience, reflecting the city’s diverse charm and appeal. From natural wonders to historical landmarks, Lagos is a city that promises unforgettable experiences for every visitor.

Roca Estate Lagos: Your Gateway to Exceptional Real Estate Services

At Roca Estate Lagos, we pride ourselves on being more than just a real estate agency, we are your trusted partner in navigating the vibrant property market of this beautiful city. With a deep understanding of Lagos and a commitment to excellence, our team of experienced professionals is dedicated to providing personalized and comprehensive services to meet your unique real estate needs. Whether you are looking to buy your dream home, invest in a lucrative property, or sell your current residence, Roca Estate stands ready to guide you through every step with expertise and care. Our approach combines local market knowledge, a vast network of resources, and a client-centered philosophy to ensure a smooth and successful real estate journey.

Our range of services includes:

- Personalized Property Search: Tailoring our search to your specific preferences and requirements, ensures that you find the perfect property that meets all your needs.

- Expert Buying and Selling Assistance: Providing professional guidance throughout the buying or selling process, from initial consultation to final transaction.

- Market Analysis and Investment Advice: Offering in-depth market insights and investment strategies to help you make informed decisions and maximize your returns.

- Property Management Services: Ensuring your property is well-maintained and profitable, whether it’s a rental investment or a second home.

- Legal and Financial Guidance: Assisting with the legalities and financial aspects of real estate transactions, including contracts, taxes, and financing options.

At Roca Estate Lagos, we are committed to turning your real estate aspirations into reality, with professionalism, integrity, and a personal touch.

Embracing Lagos: Your Journey to a Dream Property with Roca Estate

In conclusion, Lagos is a unique blend of natural beauty, rich history, and vibrant culture, making it an ideal destination for those looking for a combination of relaxation and adventure. With an abundance of stunning beaches, historical attractions, and cultural sites, there’s something for everyone, whether you’re a nature lover, a history enthusiast or simply looking for a laid-back coastal lifestyle. Lagos is not just a place to visit, it is a community to be a part of, a place to call home, and a market teeming with real estate opportunities.

Roca Estate Lagos is at the forefront of this exciting market, offering expert guidance and comprehensive services to help you navigate the diverse conditions of the Lagos real estate market. Whether you are buying, selling, or investing in real estate, our team is committed to providing you with an easy and successful experience. We invite you to explore the opportunities that Lagos has to offer and contact us with any real estate questions you may have. Let Roca Estate be your partner in finding the perfect property in this charming city.

Ready to explore real estate opportunities in Lagos? Contact Roca Estate Lagos today and take the first step towards your dream property in this charming city.

Discover lucrative opportunities with Roca Estate’s property investments in Lagos, a city known for its stunning coastline and vibrant lifestyle. Our team specializes in identifying high-potential real estate across Portugal, helping investors secure assets with strong growth and rental prospects. Learn how we guide clients through every step of the investment process on Roca Estate’s main platform.